Putting a Price on Emissions

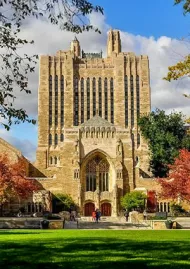

Yale University's Internal Carbon Charge Experiment

What happens when a University puts a price on its own carbon emissions?

There are few issues that sit so clearly at the nexus of socio-environmental systems as climate change. Human actions drive the emission of heat-trapping greenhouse gases. Temperatures then climb, weather patterns shift, and human and natural systems are altered. Research into the drivers, effects, and extent of climate change, as well as possible mechanisms to minimize its impacts is happening on a variety of levels around the world. With experts at the forefront of climate change research and management, a desire to use the campus as a living lab, and an engaged community of faculty, staff, students, and alumni, Yale University has a variety of goals around mitigating and adapting to climate change. This case study looks closely at one of those approaches – the institution of an internal carbon pricing mechanism. In 2015, the University decided to move forward with a pilot program designed to price the carbon emissions generated by the buildings on campus, thereby driving greenhouse gas emissions reductions and modeling behavior change around energy use. This pilot stemmed from a task force report that recommended moving forward with the concept of a carbon charge, and was proposed to test the effectiveness of four different models/incentive programs. A group of 20 buildings was selected and divided into four treatment groups with building managers and stakeholder groups engaging to reduce energy consumption. This case study will help students explore the concepts of

- Why carbon pricing might play a role in mitigating climate change

- How Yale built its pilot program,

- How the program was implemented on the ground,

- Which stakeholders were involved,

- The lessons and limitations of internal carbon pricing.

The case study is designed to be used in undergraduate and graduate level courses covering topics of environmental economics and policy, corporate social responsibility, and climate change mitigation. It may also be useful for organizations seeking to learn from the application of an internal carbon charge.