Supply and Demand of Petroleum Products

Oil and natural gas extraction had proved to be a successful industry since the early twentieth century. Petroleum products dominated the industrialized landscape. Crude oil was the source of gasoline, distillates such as diesel fuel and heating oil, jet fuel, petrochemical feedstocks, waxes, lubricating oils, and asphalt. It was the most consumed energy source - petroleum and natural gas produced 68% of the energy used in the U.S.[1]

Despite its storied history, the oil industry in the 2010s was the source of much public debate. Some posited that an energy transition was underway that would lead to a world that utilized renewable sources of energy, stranding fossil fuel assets. Others pointed to the continued high demand for oil and gas and argued that the industry would continue to thrive for decades.

Oil was expensive to find and extract. Identifying a new oil field could require years of survey work. If favorable locations were identified, companies then negotiated leases with controlling governments in order to explore a given territory. Even using advanced techniques to spot promising sites, exploratory wells (costing hundreds of millions of dollars) could prove that the targeted field had inadequate supplies to begin commercial operation.

Building production rigs to exploit a find was even costlier. Land-based oil wells cost more than $3 million just to drill, and offshore oil rigs could cost substantially more, ranging from $200 million up to a billion dollars. The largest offshore rigs could house up to 100 employees who would live on the platform for weeks at a time. The time from the purchase of a lease to the first production could be as much as 10 years.[2]

In addition to the high cost of production, oil extraction also had high ongoing risks. As an extreme example, the 2001 explosion of the Deepwater Horizon oil rig in the Gulf of Mexico caused deaths and environmental damage, costing BP over $65 billion for cleanup and other costs.

The global amount of oil reserves was difficult to estimate. A number of well-known oil fields were being depleted. However, in the 2000s, various oil companies began to deploy techniques such as fracking and the exploitation of oil sands to extract oil from fields that had been considered depleted or commercially unviable, greatly increasing the potential amount of oil that could be extracted worldwide. From time to time, severe supply shocks had roiled the market whether from geopolitical jolts such as war or from natural disasters such as weather events.

OPEC Oil Prices

Prices changed due to a variety of factors, including changes in supply and demand, availability, geopolitical events, and natural disasters. For example, when the Organization of Arab Petroleum Exporting Countries (OAPEC) declared an embargo in 1973, there were severe supply shortages worldwide. The price of a barrel of crude oil went from $1.82 in 1971 to $11.00 in 1973. In the 2000s, multiple international worries and Hurricane Katrina's impact on oil production in the Gulf of Mexico drove prices up in 2005; reduced demand during the 2008 global recession drove prices down.[3]

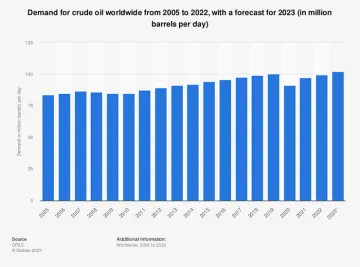

Global demand for oil and gas had been steadily increasing in the 2000s. Even as developed countries were pushing alternatives to fossil fuels, developing countries, especially China and India, were rapidly boosting consumption as they industrialized. The continued demand meant that although there were dips in the international price of oil, it had been on an upward trend since the late 1990s, and oil extraction companies were overall highly profitable. Nonetheless, the price of petroleum was volatile, and with oil as a commodity, no individual company had control of the market. As oil is moved to its destination by tankers, ownership and price might change multiple times before the ships reached their destination. The crude oil price per barrel went from $12.28 in 1998, then up to $94.10 in 2008, and down to $40.76 in 2016. [3]

Worldwide Demand for Oil