2011 Debt Limit Crisis

How Should the Fed Respond?

In July 2011, the federal government faced the looming threat of a debt default, not due to insolvency, but because Congress was refusing to increase the debt limit. This deadlock meant that the Treasury Department would be unable to issue new debt to pay off obligations and interest on existing debt.

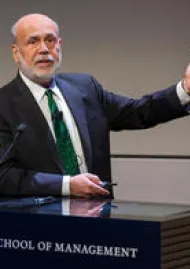

The Federal Reserve, led by Chairman Ben Bernanke, was presented with two unappealing options. The first was to implement an across-the-board delay in paying federal obligations and interest, prioritizing payments based on incoming revenues. The second option was to prioritize interest payments to bondholders to avert an immediate default, though this would disrupt other federal payments.

The broader implications of a government default were severe; it could cause financial markets to spiral, increase interest rates, and potentially reverse the fragile economic recovery from the 2008 financial crisis. Bernanke warned that a failure to raise the debt ceiling could result in ratings downgrades, increased interest costs, and damage the creditworthiness of the U.S., alongside destabilizing global perceptions of U.S. Treasury securities.

Facing these options, the Fed had to balance its independence with its mandate to ensure financial stability and economic recovery, leaving Bernanke and his team to consider extraordinary measures to mitigate market disruptions.