Shareholders

After the announcement of the new roadmap, Statoil executives began a concerted effort to explain the new policy. Their initial meetings with investors and other public statements emphasized the new focus on renewable investments. However, Statoil received skeptical responses from some of its non-government shareholders. Jon Erik Reinhardsen, chair of Statoil’s board of directors, recalled some of the investor pushback:

Some investors had said, just milk the oil and gas as long as it lasts and then end the journey. But we had decided on a different avenue, which we think will add more value over time. It has led us, in a way, to raise the bar on what kind of oil and gas projects we approve. So, on a net basis, we will probably invest less than we would have done and allocate more resources to what we consider more of the future, the renewable space.

As Saetre participated in public settings about the company, he soon realized that he was talking 50% of the time about the new division, which was only a small fraction of the company's investment and had not yet contributed revenues. He realized he needed to talk less about the new renewable area and do more to reassure investors and others that Statoil would continue to be an oil and gas company. The new strategy was designed to provide long-term results in an uncertain future, but public shareholders and Norwegian observers needed reassurance about short-term measures of stock prices and company earnings.

Also, in communications with investors, Pål Eitrheim noted that Statoil emphasized the company’s decisions on renewable investments placed value over volume. Although other companies had described extremely ambitious volume targets, Statoil's executives stressed that they were exercising capital discipline and return on equity as part of their approach. Statoil argued that this approach increased the likelihood of success. Also, because renewable projects were competing for capital internally, the new projects needed to demonstrate to employees and leaders that they were creating a profitable robust business for the long term.

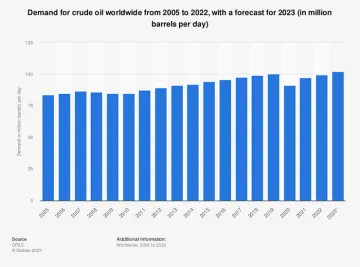

Furthermore, Statoil’s leaders stressed that Statoil remained a major player in offshore oil and that would not change in the short and medium term. Reinhardsen said, “[The new strategy] was described as a strategic move to make sure the company has a future in the longer term.” He pointed out the implications of a limited long-term future had they not articulated a low-carbon strategy. He cautioned, “It might be challenging to run an oil and gas business if you believe that the demand will fade over time.”

Over time, investor expectations changed. Siv Rygh Torstensen, Head of the CEO office at the time, recalled when she went to the regular company roadshows with investors after the policy was first announced, investor questions would be all about the financials, with only a few questions at the end for the ESG team. Gradually, investors at these meetings started asking questions about the renewable business as well.

Torgrim Reitan, former senior VP for Finance and Control in the Renewables business area before becoming Equinor’s CFO, recalled that over the years renewables had moved from an ESG topic to a value-creation story as well. “The dialogue that I typically have with investors these days is to elaborate on the profitability. The dialogue became more about “Are you able to repeat the successes in the past?” Investors came to appreciate that Statoil was moving early into renewables and that could create significant value. Reitan recalled,

When we started on this journey, the key feedback from investors was, "Fine, we understand you have to do something, but please invest as little as possible. And please don't do any big stupid acquisitions or something like that. The tone gradually changed as the ESG movement gained force, and all larger and reputable investors typically had this very high on their agenda in their dialogue with us.

Employees

Statoil had for decades developed an employee culture around its expertise in oil and gas extraction, processing, and sales. The workforce appreciated the company's reputation for high technology, safe operations, and contribution to Norway's wealth. Stig Lægreid, one of the employee representatives elected to Statoil’s board, noted,

There had been a lot of pride among the employees about being the cash cow for the Norwegian state. Many have had a long life in oil and gas and were concerned about what the new policy would do to those positions. There were also some skeptics when it came to the climate situation. But overall, there was a very, very, positive response to the development.

Many executives believed that CEO Eldar Sætre was a key factor in persuading the workforce about the change. Employees appreciated his long experience with the company, having spent his entire 35-year career with Statoil. Sætre could translate what the changes would mean for employees at all levels of the company and convey his enthusiasm for the new long-term view. He could demonstrate the benefits of the new strategy for Statoil, the country, and the climate. In presenting the strategy, he repeated a simple phrase – “always safe, high-value, low-carbon.” Pål Eitrheim recalled his experience,

When the new CEO [Sætre] came in and very firmly put renewables on the agenda, I was the country manager in Brazil running an operation that was oil based. In every employee town hall, I was getting questions from employees about whether or not we should broaden into renewables in Brazil. And typically, those questions came from relative newcomers to Statoil and relatively young members of staff. When I returned after nearly three years in Brazil, I was very firmly convinced that this sentiment was intensifying. I think this was not something that only the new CEO saw. I think leaders on the levels below the executive committee were experiencing the sentiment in our regular fossil-based senior leadership jobs.

As they began discussing the new broad energy strategy, Statoil's executives hoped to elicit a positive reaction from the more than 20,000 employees worldwide. They held company-wide meetings and provided information to inform employees of what would be changing and what would not.

While presenting the new strategic plan to employees, Statoil’s leaders worked to assure them that the company was not abandoning oil and gas. They also emphasized that the company would also be addressing environmental concerns within the oil and gas divisions, by far the largest part of the company. The leadership emphasized that the company would be looking for ways to reduce carbon in the extraction and processing of fossil fuels. In addition, they would explore options to create new revenue streams by taking carbon capture and storage as well as producing various forms of hydrogen to market.

Irene Rummelhoff, Executive Vice President of the business area New Energy Solutions (NES), and other executives worked to make the organization see that the whole company was part of this new direction. She said, “I really enjoyed meeting with the rest of the organization and saw the pride in the rest of the organization when they could help out from time to time.” She felt that the new energy transition would succeed only if the two efforts were not seen as completely divided, with - some people working only on renewables and others working only on oil and gas. “It has to be that everyone, to some degree, takes part in the energy transition.”

Sven Skeie, Equinor, an executive in the CFO area, also noted the benefits to employees of having a wider range of businesses. Employees could move among a variety of businesses without leaving Equinor. Employees could bring their existing knowledge and then add new skills in a new area. The wider scope and longer-term vision were attractive to new employees, particularly younger employees joining after finishing their degrees.

One motivating factor for employees to embrace the change was the response they received from the larger communities. Many employees reported that their families were pleased that Statoil was addressing climate issues. Rummelhoff said,

I've never had a job where so many people were cheering for me. The rest of the company wanted us to succeed because it made them proud that we were being an early mover in this transitioning phase of the large oil and gas companies. My kids were super excited about my job, and even my neighbors wanted the group to succeed. We tried to create an entrepreneurial lean mindset, but wherever we turned in the larger organization, people were ready to help out and engage, and sometime almost too eager to help.

Another selling point for the new strategy was the strength that came from articulating a long-term vision. The long-term vision became a big help in recruiting employees, even on the oil and gas side. Equinor strengthened its position as one of the top employee choices for Norwegian college graduates. It was already the top choice of engineering students, and its appeal grew with students in economics and IT. Sætre pointed out the power of articulating a long-term strategy, “Employees would not be enthusiastic about working for a dying company.”

Environmental Activists

Statoil's strategy as described in the Climate Roadmap set goals for investing in renewables for the future. However, the roadmap presumed that there would continue to be a need for oil and natural gas, well into the future, and the company should continue to supply those energy needs. For the most part, the general public in Norway supported the new direction. But, in spite of the new commitment to invest in renewables, many environmental groups in Norway opposed the roadmap, arguing that by continuing to invest in oil and gas Statoil would be supporting activities that were producing climate change. Many environmental groups believed that in addition to reducing demand for fossil fuel, companies and countries should stop investing in activities that increased the supply of gas and oil. Any additional fossil fuel infrastructure, they argued, would create resources that pushed the world beyond the 1.5C standard set in Paris.

Statoil was not surprised by the activists' response. Looking back at that time, Jannik Lindbæk, EVP of Communications, noted,

There are NGOs and political parties that believe in an active phasing out oil and gas. On the other side, you have those that aren't really concerned about climate issues. But I think in the Norwegian public, there's a broad consensus in the middle that supports the continued activity on the NCS for the industry, balanced with a commitment to reduce GHG emissions. So we have a foundation that we can rely on. We must nurture their trust and ensure that these individuals have what they need to understand what we do. To keep their support, we need to continue to openly share information about how and what we are doing and how that is in line with what we’ve stated as our strategy.

Norwegian political parties such as the Green Party and Socialist Left Party argued that the plan and continued exploitation of the Norwegian Continental Shelf would create further dependence on what they believed would be a dying industry due to declining demand. Otherwise, the main governing parties and labor unions supported the plan. In general, the various governments over the last decades have maintained a bi-partisan and consistent approach to develop the resources on the NCS. Otherwise, all the mainstream political parties and labor unions supported the plan. In general, the government and the company have mounted various counterarguments to activists. An academic paper summarized the three counternarratives used by the oil industry to address those who argued that Norway should voluntarily restrict the supply of oil and gas:

- Natural gas is a cleaner fuel than coal and continued gas production could help phase out coal usage.

- It is futile to adopt unilateral supply restrictions in a global market because cuts in Norwegian petroleum production would merely result in increases from other producing countries.

- Norway (and Statoil) needs the revenues supplied by oil and gas to fund the country’s own transition to net zero and fund new investments in renewable technologies.